reverse sales tax calculator quebec

This reverse sales tax calculator will calculate your pre-tax price or amount for you. This total rate is a combination of a Goods and Services.

![]()

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

In Quebec the provincial sales tax is known as Quebec sales tax.

. However the final rate remains the same since 2012 as the. Reverse Sales Tax Calculator Quebec. The cumulative sales tax rate for 2022 in Quebec Canada is 14975.

This is the after-tax amount. Reverse Sales Tax Rates. Qst stands for quebec sales tax.

Tax rate GST and QST for 2019. Check home page if you need. The QST rate is the same since 2013 at 9975.

Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at. All numbers are rounded in the normal fashion.

The following table provides the GST and HST provincial rates since July 1 2010. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

Below is a table of common values that can be used as a quick lookup tool for a sales tax rate of 14975 in Quebec Canada. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. You will need to input the following.

If you make 52000 a year living in the region of quebec canada you will be taxed 15237. Calculez vos taxes tps et tvq dès maintenant. Amount without sales tax GST rate GST amount.

Canada Sales Tax Chart Date Difference Calculator. Welfare in Quebec is way worse a single person in quebec gets 708 a month doesnt leave much to live off when. Reverse Sales Tax Formula.

Calculates the canada reverse sales. What is the sales tax rate in Quebec for 2022. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

GST rates are the same since 2008 at 5. Harmonized reverse sales tax. The rate you will charge depends on different factors see.

Type of supply learn about what. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. GST and QST apply to the price.

Enter the final price or amount.

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Quebec Tax Calculator Gst Qst Apps On Google Play

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Canada Tax Calculator Gst Hst Skachat Prilozhenie Na Appru

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Income Tax Calculator Calculatorscanada Ca

How To Add Sales Tax 7 Steps With Pictures Wikihow

Do I Need To Collect Sales Tax For Selling Online Quaderno

Sales Tax Guide For Shopify Sellers

Sales Tax Guide For Online Courses

Calcul Taxes Calcultaxes Profile Pinterest

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Taxable Income Formula Examples How To Calculate Taxable Income

Calcul Taxes Calcultaxes Profile Pinterest

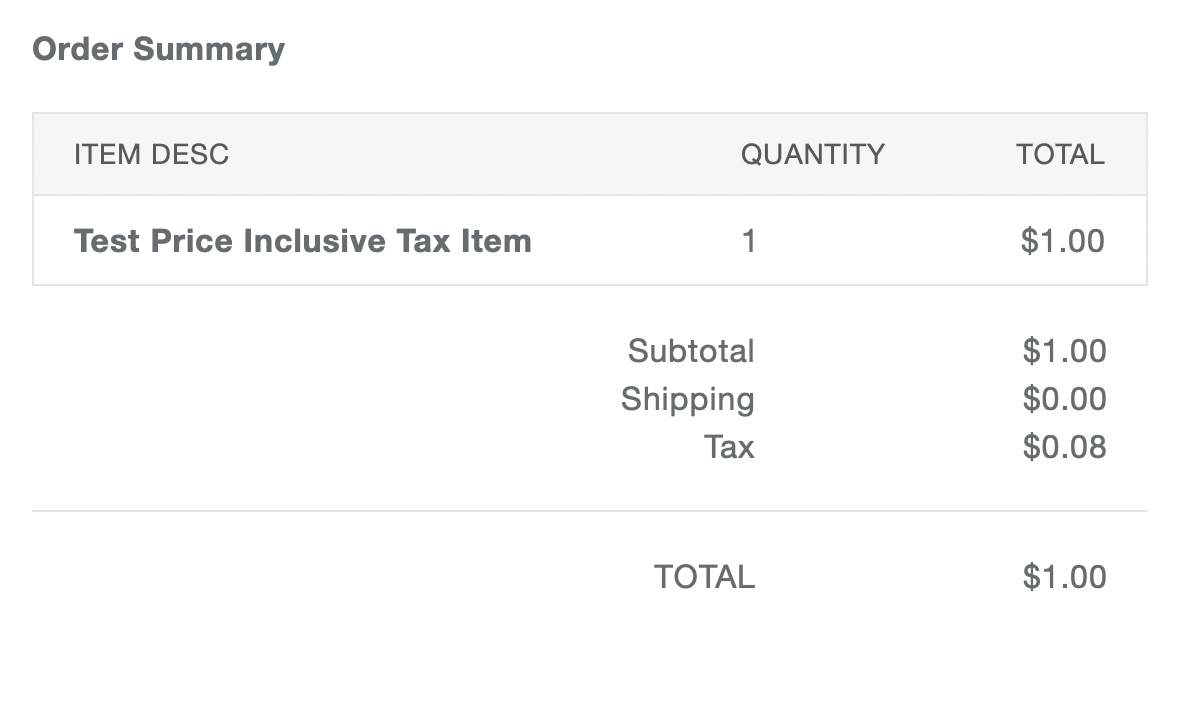

Square Online Tax Settings Square Support Center Us

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada